If you are not married in the NOL year (or are married to a different spouse), and in the carryback year you were married and filed a joint return, your refund for the overpaid joint tax may be limited. You can claim a refund for the difference between your share of the refigured tax and your contribution toward the tax paid on the joint return. The refund cannot be more than the joint overpayment.

- Although net operating loss may, at first glance, seem like a negative, if you utilize your tax credits strategically, you may receive a refund of taxes that were paid previously or carry credits forward indefinitely with restrictions.

- ProSeries Basic 2021 and prior doesn’t support the Net Operating Loss Worksheet.

- The acknowledgment must be obtained by the due date (including extensions) of the corporation’s return, or, if earlier, the date the return is filed.

- Carry the unused NOL to the next carryback or carryforward year and begin again at Step 4.

Examples of Net Operating Loss

This disallowed tax-exempt use loss can be carried over to the next tax year and treated as a deduction with respect to the property for that tax year. Limitations on passive activity losses and credits under section 469 apply to personal service corporations (defined earlier) and closely held corporations (defined later). Generally, an accrual basis taxpayer can only deduct business expenses and interest owed to a related party in the year the payment is included in the income of the related party.

File your taxes, your way

Do not enter “See Attached” or “Available Upon Request” instead of completing the entry spaces. If more space is needed on the forms or schedules, attach separate sheets using the same size and format as the printed forms. Losses originating in tax years beginning before Jan. 1, 2018, are still subject to the former tax rules. Any remaining losses will expire after 20 years. The Coronavirus Aid, Relief, and Economic Security (CARES) Act effectively suspended the changes made by the TCJA.

Net Operating Loss (NOL): A Detailed Guide

An exception applies to subsidiaries of corporations whose returns are filed with the parent’s electronically filed consolidated Form 1120. These subsidiaries should enter “Applied For” in the space for the EIN on their returns. The subsidiaries’ returns are identified under the parent corporation’s EIN.

A farming business does not include contract harvesting of an agricultural or horticultural commodity grown or raised by someone else. It also does not include a business in which you merely buy or sell plants or animals grown or raised entirely by someone else. Enter on line 7 only income that is not related to your trade or business or your employment. Don’t include on this line any section 1202 exclusion amounts (even if entered as a loss on Schedule D (Form 1041)). If your NOL deduction includes more than one NOL amount, apply Step 5 separately to each NOL amount, starting with the amount from the earliest year. If you qualify to use IRS FreeFile – there is no fee to file those returns.

If the corporation had gross receipts of at least $500 million in any 1 of the 3 preceding tax years, complete and attach Form 8991. For this purpose, the corporation’s gross receipts include the gross receipts of all persons aggregated with the corporation, as specified in section 59A(e)(3). See the Instructions for Form 8991 to determine if the corporation is subject to the base erosion minimum tax. If the corporation made any payments in 2023 that would require the corporation to file any Forms 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, and 1042‐S, Foreign Person’s U.S. Source Income Subject to Withholding, check the “Yes” box. See the Instructions for Form 1042 and Instructions for Form 1042‐S for information regarding who is required to file Forms 1042 and 1042‐S and what types of payments are subject to reporting on Forms 1042 and 1042‐S.

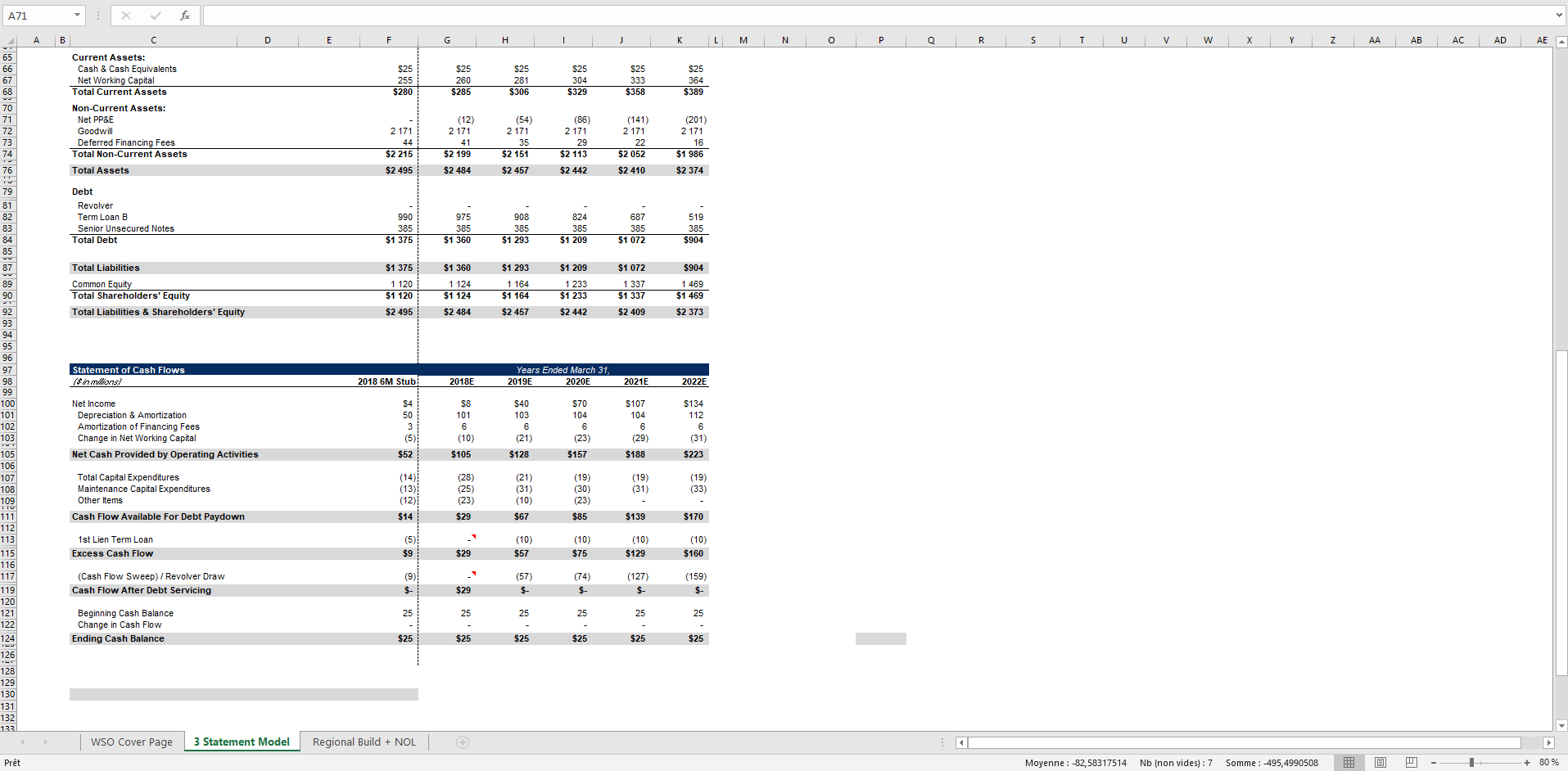

From these assumptions, the NOLs are equal to $1m in 2019 since the NOLs carry-back is calculated as the sum of the taxable incomes from the prior two years. However, the Tax Cuts and Jobs Act of 2017 (TCJA) prohibited the carryback of NOLs, but in return, taxpayers were allowed nol carryover worksheet excel to carry forward NOLs indefinitely. If the company becomes profitable later down the road, the NOLs can be “carried forward” to reduce the tax burden in upcoming profitable periods. Net Operating Loss (NOL) is the tax benefits provided to a company operating at a loss under U.S.

For the latest information about developments related to Pub. 536, such as legislation enacted after it was published, go to IRS.gov/Pub536.

An exception applies for NOLs of insurance companies other than life insurance companies. The 80% taxable income limit does not apply to these entities. The corporation’s taxable income cannot be less than the largest of the following amounts. Treat any loss from an activity not allowed for the tax year as a deduction allocable to the activity in the next tax year.

If two or more amounts must be added to figure the amount to enter on a line, include cents when adding the amounts and round off only the total. If the corporation receives a notice about penalties after it files its return, send the IRS an explanation and we will determine if the corporation meets reasonable-cause criteria. Do not attach an explanation when the corporation’s return is filed. 542, Corporations, for more information on how to figure estimated taxes. Complete every applicable entry space on Form 1120.

Click here to learn more about FreshBooks tax accounting software and how working with a tax professional can help you maximize tax benefits for your small business. Although net operating loss may, at first glance, seem like a negative, if you utilize your tax credits strategically, you may receive a refund of taxes that were paid previously or carry credits forward indefinitely with restrictions. To stay on top of your small business net income, you may wish to utilize an accounting template.