This chapter explains how to determine which MACRS depreciation system applies to your property. It also discusses other information you need to know before you can figure depreciation under MACRS. This information includes the property’s recovery class, placed in service date, and basis, as well as the applicable recovery period, convention, and depreciation method. It explains how to use this information to figure your depreciation deduction and how to use a general asset account to depreciate a group of properties. Finally, it explains when and how to recapture MACRS depreciation. You use an item of listed property 50% of the time to manage your investments.

Declining Balance Depreciation Calculator

- The business use of your automobile, as supported by adequate records, is 70% of its total use during that fourth week.

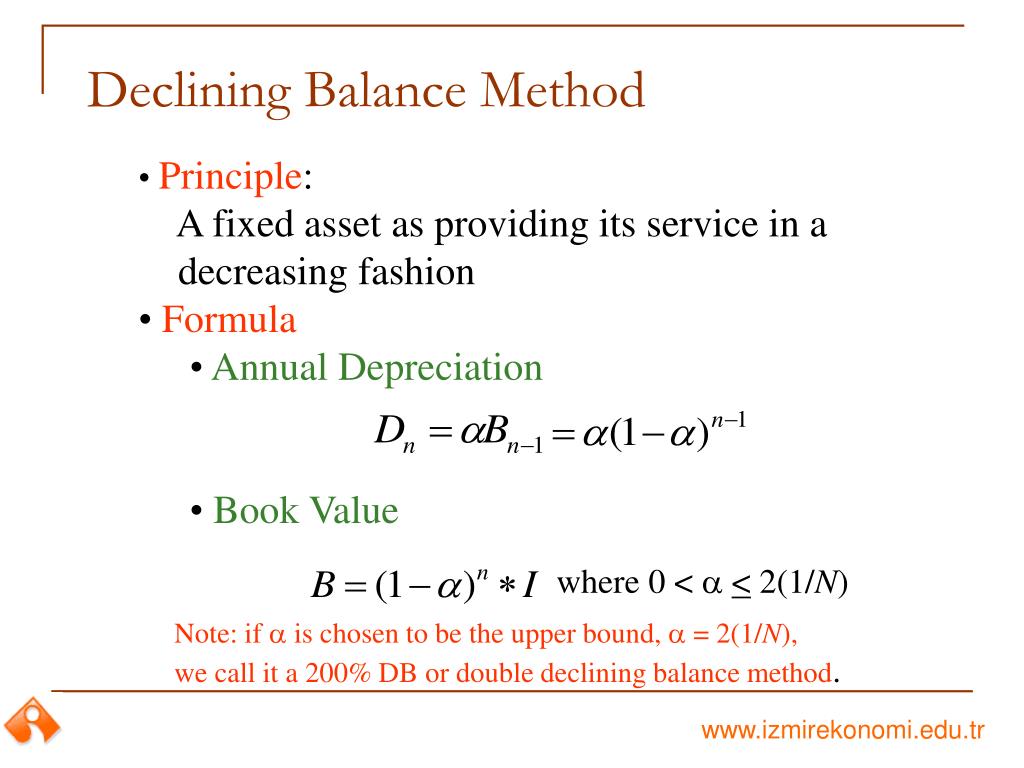

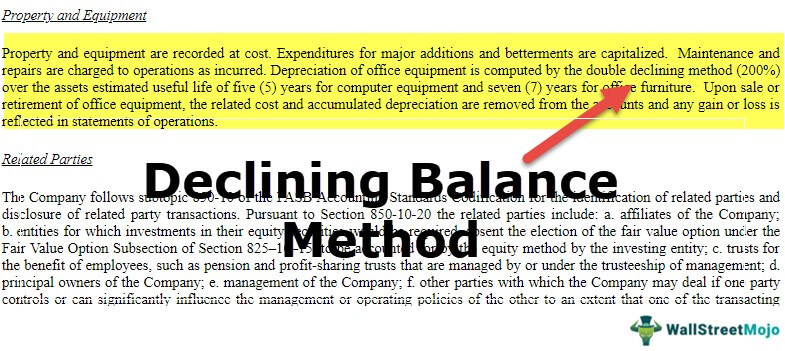

- This is because, unlike the straight-line method, the depreciation expense under the double-declining method is not charged evenly over the asset’s useful life.

- The company includes the value of the personal use of the automobile in Richard’s gross income and properly withholds tax on it.

- Passenger automobiles; any other property used for transportation; and property of a type generally used for entertainment, recreation, or amusement.

- You may have to recapture the section 179 deduction if, in any year during the property’s recovery period, the percentage of business use drops to 50% or less.

- An addition to or partial replacement of property that adds to its value, appreciably lengthens the time you can use it, or adapts it to a different use.

Step 2—Using $1,180,000 as taxable income, XYZ’s hypothetical section 179 deduction is $1,160,000. In 2023, Jane Ash placed in service machinery costing $2,940,000. This cost is $50,000 more than $2,890,000, so Jane must reduce the dollar limit to $1,110,000 ($1,160,000 − $50,000). However, to determine whether property qualifies for the section 179 deduction, treat as an individual’s family only their spouse, ancestors, and lineal descendants and substitute “50%” for “10%” each place it appears. May Oak bought and placed in service an item of section 179 property costing $11,000.

What Is the Double-Declining Balance (DDB) Depreciation Method?

However, the final depreciation charge may have to be limited to a lesser amount to keep the salvage value as estimated. If the fixed asset doesn’t have the salvage value or its salvage value is zero, the company usually charges the remaining balance of the net book value as depreciation expense when its net book value is considered insignificant. This is usually when the net book value of the fixed asset is below the minimum value that asset is required to be capitalized (which should be stated in the fixed asset management policy of the company). Assets that face a relatively high risk of technological obsolescence progressively decrease the competitive advantage a company can gain from their use. The depreciation method used should therefore charge a higher portion of the cost of such assets in the earlier years which is why reducing balance method is most appropriate.

Ask a Financial Professional Any Question

We will look at the case of Carl’s Construction Company (“CCC”). CCC purchased new machinery for the construction business at a cost of $50,000 with how to build value stream maps using kanban a salvage value of $4,000. Based on past experience, the same type of machinery has a useful life of 8 years and is depreciated at a rate of 15%.

The machine is expected to have a $1,000 salvage value at the end of its useful life. Depreciation rate in the formula of declining balance depreciation above is the rate that the management of the company decides on each type of fixed asset based on their past experiences and how the assets are being used. Also, this yearly rate of depreciation is usually in line with the industry average. A declining balance method accelerates depreciation so more of an asset’s value can be recorded earlier in its useful life. The flip side is that less of its value can be claimed in its later years.

You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or with sufficient evidence to support your own statements. For listed property, you must keep records for as long as any recapture can still occur. On August 1, 2022, Julie Rule, a calendar year taxpayer, leased and placed in service an item of listed property. Julie’s business use of the property was 50% in 2022 and 90% in 2023. Julie paid rent of $3,600 for 2022, of which $3,240 is deductible. The $147 is the sum of Amount A and Amount B. Amount A is $147 ($10,000 × 70% (0.70) × 2.1% (0.021)), the product of the FMV, the average business use for 2022 and 2023, and the applicable percentage for year 1 from Table A-19.

In addition to being a partner in Beech Partnership, Dean is also a partner in Cedar Partnership, which allocated to Dean a $30,000 section 179 deduction and $35,000 of its taxable income from the active conduct of its business. Dean also conducts a business as a sole proprietor and, in 2023, placed in service in that business qualifying section 179 property costing $55,000. If you place more than one property in service in a year, you can select the properties for which all or a part of the costs will be carried forward.

For example, laptop computers are typically only used for a few years, after which faster laptops become available and the older ones are more likely to be replaced. More commonly, these methods are used to reduce the amount of taxable income in the near term, so that a firm’s tax liability can be pushed out into later periods. Thus, a declining balance method can improve the cash flow of a business by reducing the amount of taxes payable in the short term. In the step chart above, we can see the huge step from the first point to the second point because depreciation expense in the first year is high. This concept behind the DDB method matches the principle that newly purchased fixed assets are more efficient in the earlier years than in the later years.