It can help identify areas for improvement and ensure that the organization is moving toward its overall goals. The management team maximizes revenue while controlling costs, as their performance is evaluated based on the center’s profitability. They are responsible for making decisions related to investments, product development, and sales and marketing, among other things. Moreover, cost centers are accountable for controlling and avoiding unnecessary expenditures, as their primary objective is to support the rest of the organization cost-effectively. Profit centers are evaluated based on their ability to generate revenue and profits, and their success is measured by KPIs such as revenue growth, gross margin, and net income.

Cost Control Mechanisms in Cost Centers

In this article, we will explore the characteristics of cost centers and profit centers, highlighting their differences and similarities. Each profit center is accountable for generating revenue, managing costs, and achieving profit targets independently. While cost centers may indirectly contribute to revenue generation by supporting the activities of profit centers, their primary role is to provide support and services cost-effectively. Cost centers typically do not have the autonomy or authority to set prices or make strategic decisions that directly impact revenue generation. The primary objective of cost centers is to manage costs and expenses effectively to support the company’s overall operations. Cost centers are responsible for providing support and services to other departments within the organization, and their goal is to do so cost-effectively.

Contribution to revenue

If any organization thinks that the cost centers are not required to generate profits, they should think twice. Because without the support of cost centers, it would be impossible to run a business for a long period. Another important cost expense ratio calculator the real cost of fees control mechanism is process optimization, which involves streamlining workflows to eliminate inefficiencies and reduce costs. Techniques such as Lean management and Six Sigma can be employed to identify waste and improve processes.

Invest in Employee Training – Strategies for Effective Management of Cost Centers

Their goal is to maximize revenue while managing costs to ensure sustainable profits and contribute to the company’s long-term success. The efficiency of cost centers is often measured by their ability to deliver high-quality services within budgetary constraints. This requires a meticulous approach to resource allocation and process optimization. For example, an IT department that effectively manages its resources can reduce downtime and improve system reliability, which in turn supports the productivity of other departments. By implementing best practices and leveraging technology, cost centers can achieve significant cost savings and operational improvements. The primary purpose of a cost center is to track and allocate costs within an organization.

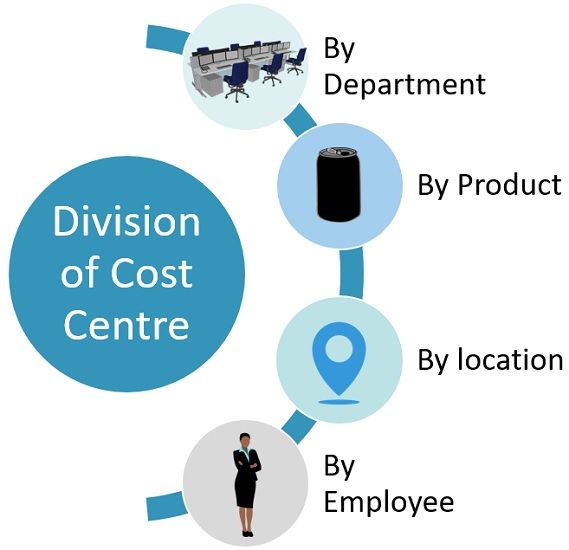

A cost center is a unit of a business that isresponsible for incurring of costs. A cost center is generally that part of abusiness that does not directly generate revenue but supports the functioningof key revenue generating departments of a business. Cost centers are responsible for managing and controlling expenses within an organization. By carefully operating expenses, cost centers can help organizations optimize costs and improve profitability. In cost centers, the primary goal of management is to control costs and ensure that the center operates efficiently. They are responsible for ensuring that resources are utilized effectively, and the prices are within the allocated budget.

Profit Centers Generate Revenue – The Importance of Cost Centers and Profit Centers in Achieving Organizational Goals

- For example, a profit center in the form of a regional sales office can tailor its marketing campaigns to local preferences, thereby enhancing customer engagement and boosting sales.

- An example of a profit center is a subsidiary, which is responsible for the amount of sales generated, as well as all costs incurred.

- However, if the center is unlikely to generate substantial revenue, a cost center may be more appropriate.

- Positive cash flow indicates that a profit center is generating enough cash to sustain its operations and invest in growth opportunities.

This autonomy allows profit centers to make decisions that directly affect their financial performance, such as pricing strategies, marketing efforts, and product development. For instance, a retail store within a larger corporation operates as a profit center, with its success measured by sales and profitability. In conclusion, cost and profit centers are distinct business units with unique characteristics, advantages, and disadvantages. Cost centers are responsible for managing and controlling costs within an organization.

Cost centers are typically evaluated based on their ability to manage costs effectively and efficiently. It is done through cost accounting, which involves tracking, analyzing, and allocating costs to different business units within the organization. Of course, profit centers are backed up by cost centers to generate profits, but the functions of profit centers are also noteworthy. It’s worth noting that even within the same company, different departments may operate as either cost or profit centers, depending on their function and objectives.

Conversely, cost centers are typically more tightly controlled, with a focus on cost reduction and efficiency improvements. Managers of cost centers are tasked with finding ways to deliver their services more effectively while adhering to budgetary limits. Revenue generation is not a primary objective for cost centers, as their main focus is effectively managing costs and expenses.

A well-structured budget provides a roadmap for cost centers, guiding them in their day-to-day operations and long-term planning. Cash flow analysis is also essential for evaluating the financial performance of profit centers. Positive cash flow indicates that a profit center is generating enough cash to sustain its operations and invest in growth opportunities. This metric is vital for understanding the liquidity and financial stability of the profit center. For instance, a profit center with strong cash flow can easily fund new projects, pay off debts, and navigate economic downturns, thereby ensuring long-term sustainability. The managers or executives in charge of profit centers have decision-making authority related to product pricing and operating expenses.

A cost center is a subunit of a company that takes care of the costs of that unit. On the other hand, a profit center is a subunit of a company that is responsible for revenues, profits, and costs. These departments are essential to the overall operations of a company, but they don’t directly generate profit. Instead, they generate and manage the costs that keep the business running smoothly.